This blog is part of a series commissioned by PWYP’s strategy sub-committee (made up of members of PWYP’s Global Council, Africa Steering Committee and Board). The proposals and positions of each guest author are not endorsed by PWYP; rather they have been invited to share them in order to prompt our collective thinking as we envision our next global strategy.

It is an unbelievable time. Despite COP28’s commitment to phase out fossil fuels, there are no signs that we will stop extracting oil and gas, and we continue to extract greater quantities of minerals for development and the energy transition.

In the process, we run rough-shod over local communities, Indigenous peoples and the environment. The current system is clearly unfair and relates to a deeply moral issue: what kind of planet and society are we leaving our children and future generations?

Anti-extractivism and resource nationalism

Almost everyone finds some mining objectionable, be it the mine in our village or all coal mines in the world; mining from the oceans or extracting in protected areas.

Yet almost no-one demands a complete stop to all extraction planet-wide. Because it would mean no more phones, cars or plastic, no iron or gold, and everyone would be living in houses made from plants. This is quite unimaginable, and many peoples’ living conditions still need to improve.

In minerals-rich countries, two visions exist simultaneously. At the local level, anti-extractivist communities rightly object to mines in their areas, while at the national level, there is hope that selling minerals would help eliminate poverty and bring prosperity (“resource nationalism”). How can we reconcile these perspectives?

Natural resources as a shared inheritance

If extraction has to occur, all stakeholders must be treated fairly: extractors, employees and contractors, governments, local communities, the environment, etc. But a key stakeholder is usually forgotten: the owner of the minerals before extraction.

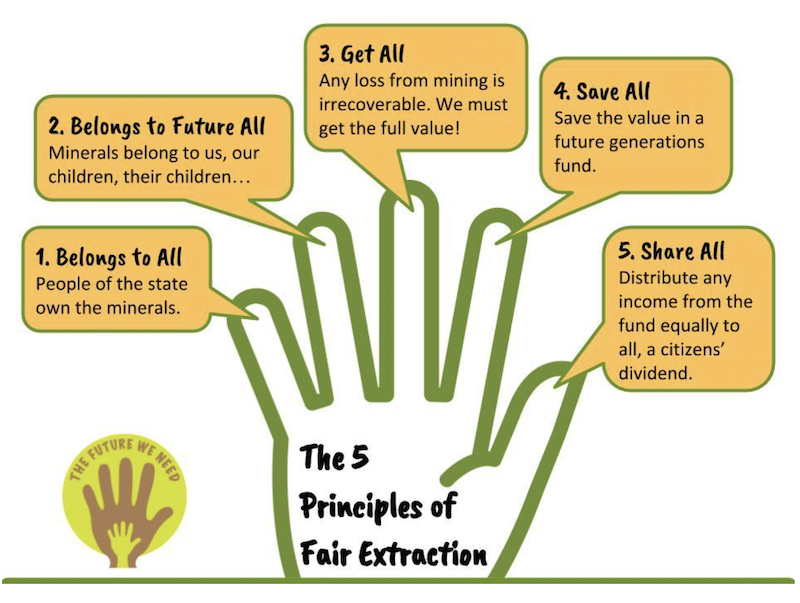

Nation states have permanent sovereignty over their natural resources. Ownership of minerals is usually assigned to some level of government representing a collective (state/province, tribe, etc.). In effect, minerals are held on behalf of the people that constitute the collective. And since the collective is a perpetual, multi-generational entity, the natural resources are the right of all future generations as well.

If we see natural resources as a shared inheritance, from the mineral owner’s perspective, extraction is the conversion of mineral wealth into other forms of wealth. Intergenerational equity and sustainability require us to ensure that future generations inherit at least as much as we did.

We then have two choices.

Either the anti-extractivist way: leaving the minerals where they are, our children will inherit them like we did, this is the only way to achieve intergenerational equity.

Or the resource nationalist way: extracting and investing to ensure our children inherit total assets that are at least as valuable as the extracted minerals.

How can the people benefit from their natural resources, now and in the future?

If extraction is essentially the conversion of wealth, then the extractor is merely an outsourced wealth management service provider, who should be managed, regulated and paid accordingly.

The goal of the mineral-owning representative government should be zero loss in value in the conversion process. Unfortunately, huge losses are common place, and what is received is treated as income and consumed.

Between the extractor, the politicians and their cronies, the desire for wealth and retaining power drives most of the human rights and environmental abuses that accompany extraction.

Present and future generations are being cheated, and in a cruel twist, the wealth that is being stolen from them is being used to sustain the corrupt system.

In order to achieve fair mining, beyond zero loss when selling mineral wealth, the entire mineral sale proceeds must be invested in assets that retain value over generations. Traditionally, this was land, precious metals and stones. Today, Norway’s oil fund, as an endowment fund with inflation-proofing, is rightly considered a best practice in saving for future generations.

And the income from the fund should be distributed equally to the general population as a commons dividend. Future generations will inherit the fund and benefit from it.

Crucially, the dividend creates a link between the entire population and their fund and mineral inheritances, which then makes zero loss more likely in practice.

From an economic standpoint, it is easy to show that this is superior to current best practice. And most of all, it is fair.

But this is not enough. Extraction impacts other inheritances and fair mining requires them to be properly addressed as well:

- To protect the environment and local communities, under the Precautionary Principle, we must create no-go areas. We must guarantee local communities’ Free, Prior and Informed Consent (FPIC), ensure strong environmental regulations, and prohibit potentially high-risk practices. We must cap extraction across multiple projects to limit cumulative damage.Under the Polluter Pays Principle, we must require the Mitigation Hierarchy – avoid, restore, offset, compensate. We should leave future generations with more forests, clear streams, etc. than we have. Mining projects should improve the environment and leave the community better off, not simply avoid harming them. Some minerals like fossil fuels have trans-national impacts, and this again requires both capping extraction globally as well as compensating for loss and damages.

- The jobs and income that extraction creates are also inherited opportunities that deplete with extraction. This understanding drives the widespread demands for local content, local procurement and local employment. Mineral owners must have the first right to these opportunities. Further, extraction must be capped to ensure future generations can also benefit from the income from extraction.

- Similarly, the opportunity to use the mineral for useful things (swords or ploughshares) is a valuable one-time inheritance. This understanding drives some countries to designate some of their minerals as strategic reserves for future generations to use while importing minerals for their current needs.

- Another inheritance is the opportunity to use extraction to develop other aspects of the society. Some countries have deliberately used a new mine to create shared-use infrastructure at low incremental cost. Other countries insist on domestic value addition, with the eventual goal to create core competencies. As these are one-time opportunities, it is essential to capitalize on them.

What could this mean for PWYP?

Protecting great inherited wealth against theft, loss or waste requires a mindset of stewardship to ensure we fulfil our duty to ensure future generations inherit at least as much as we did. This suggests potential global campaigns for the PWYP community:

- In order to prevent theft during the extraction process, the trustee/manager must implement a first-rate control system. This includes a high security mineral supply chain system, best practices from outsourcing contracts, system auditors, a whistleblower reward and protection scheme, etc.

- Thieves should not be entrusted with humankind’s wealth. Further, minerals are a regular part of money laundering/terrorism finance. Fit and Proper Person Tests (and Integrity Due Diligence more generally) are essential for all involved in handling our wealth.

- We each have a duty to future generations to ensure that our shared inheritance is intact. Therefore, the people, as the real owners, should be empowered to verify that their duty to future generations has been fulfilled. This requires Radical Transparency including open access to the public to all data in real time at no cost. Extractors should be required by law to disclose all extraction information without exception. This goes far beyond the EITI standard.

Only if ALL of this takes place would we truly achieve intergenerational equity and sustainability. Anything less cheats our future generations of their inheritance – they would prefer we leave the minerals in the ground. We hope more national coalitions will join with us to advocate for the shared inheritance approach to mineral wealth and extractives. Together, we can make great changes!

Co-Authors:

Simon Taylor, co-Founder & Board member of Global Witness, and co-Founder of PWYP

Saswati Swetlena, National Coordinator, Mineral Inheritors Rights Association (the PWYP India coalition)

Mike McCormack, Director, Policy Forum Guyana

Patrick Bond, Distinguished Professor and Director of the Centre for Social Change, University of Johannesburg

Rahul Basu, Research Director, Goa Foundation, India