Publish What You Pay is working on a Global Strategy which will serve to guide the movement from 2020-25. As part of this process we are reflecting on key questions facing the movement, through Think Pieces and webinars which will raise some key questions from the piece. Find out more about the PWYP Global Strategy process by watching this explanatory video.

This particular piece explores what tax justice means for transparency in the extractives sector.

—-

Tax Justice and Extractive Transparency: Two faces of the same coin

By Kwesi Obeng

There are three main revenue sources for a government – (i) tax revenue (ii) non-tax revenue and (iii) borrowing. But taxation is central to the development of any country. Successive major leaks in recent years from Swissleaks to Paradise Papers demonstrate how the network of global tax havens and the secrecy they engender continue to flourish and undermine resource rich countries’ ability to mobilise domestic revenue to underpin their development.

What is Tax Justice?

Tax justice is about ensuring that all individuals and companies pay the right amount of tax to ensure a sustainable and functioning democracy. It about enabling states to collect the domestic revenues needed to provide for the basic needs of their citizens, tackle inequality and promote social well-being. In effect, it is about ensuring that all tax payers pay their fair share of taxes to ensure sustainable development and a functioning democracy.

Why tax justice is important

A functioning state that can meet the basic needs of its citizens must rely ultimately on its own revenues to pursue its development agenda. Using the tax system, a state can mobilise domestic resources, redistribute wealth and provide basic essential services and infrastructure to tackle poverty and inequality. Effective tax structures can also create incentives to improve governance, strengthen channels of political representation and curb misuse of public funds.

The extractive sector and tax justice

Oil, gas and minerals are a finite resource. This makes it even more important that the revenues they generate are invested in public services, infrastructure and economic diversification. This is essential for intergenerational equity and to help economies to transition to low carbon economic pathways (as part of the response to climate change).

During the 2002-2008 commodity price boom, the turnover in the mining sector rose globally by a factor of 4.6, yet tax revenues earned by African countries, for example, went up by only a factor of 1.15.

In many resource rich countries, growth in the extractives sector has not led to increased revenue from taxation or benefits for citizens in terms of public services or poverty reduction. It has mainly benefited multinational companies and their shareholders and a few wealthy individuals.

In many countries the extractives sector is not paying its fair share of tax because of 1) overly generous tax incentives and 2) tax dodging or aggressive tax practices by companies and individuals.

1) Overly generous tax incentives offered by national governments

These can include reductions in, or simply very low, royalty and corporate income tax rates, exemptions from import taxes; generous rules regarding capital allowances and the treatment of losses for tax purposes.

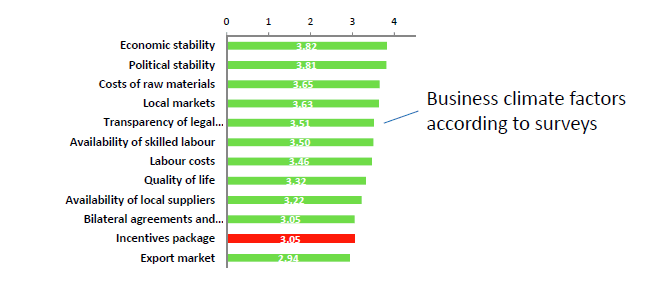

Whilst tax incentives can attract investment, multinational companies also consider other factors like economic and political stability alongside these incentives and there is limited evidence to show that incentives have supported Governments to spur broad-based growth and development.

See chart below:

Source: IMF

There is a lack of transparency about the tax incentives that Governments are offering and how they are weighing up the loss of tax revenue against the supposed benefits of extractives. This lack of transparency creates opportunities for corruption and can warp the governance of the extractives sector in a country.

2) Tax dodging and aggressive tax practices by companies and individuals

In many developing countries, the extractives sector is not creating significant numbers of jobs for local people – so they are not directly benefiting from the incentives that are offered. This makes it even more important that corporate income tax (CIT) is paid so that the tax revenues can be invested in public services and infrastructure.

However, large corporations often find clever ways to avoid paying their fair share of taxes in the jurisdictions where they make the profits due to weaknesses in the global tax architecture. In developing countries it is unrealistic to expect that weak and under-resources national revenue authorities can take on these companies who often have strong allies in Government.

“Multinational companies have a strong incentive to shift profit as a result of the differing tax burden between producing countries, home countries and tax havens. Through elaborate networks of subsidiaries, companies shift profits out of highly taxed producing countries to lower tax jurisdictions, while at the same time shifting costs into those same highly taxed producing countries.”

PWYP Canada report Million Ways to Lose a Billion

How can PWYP and the Tax Justice Movement work together?

In many countries, PWYP members are actively engaged in discussions around taxation. This thought piece (and the linked webinar) is an attempt to engage more members and coalitions in the debate about PWYP’s role in Tax Justice.

On tax incentives

- PWYP can advocate at all levels for greater transparency in the tax incentives offered by national Governments and the disclosure of contracts and associated commitments between the Government and companies. (Chain for Change Step 4)

- PWYP should also advocate for strengthened oversight and greater engagement of civil society and communities affected by mining in discussions about the anticipated benefits (and costs) of extraction.

On tax dodging and harmful tax practices

- PWYP has the potential to mobilise transnationally (both in the country where extraction is happening and in the country where an MNC is registered) and to use information to ‘follow the money’ and highlight harmful tax practices.

Questions for PWYP members

- Should PWYP form a more explicit partnership or alliance with the Tax Justice Movement?

- Should PWYP invest resources in the key areas of overlap between its core focus on the extractives sector and the focus of the Tax Justice Movement on tax havens and the offshore sector?

- Should PWYP (on an opt-in basis) strengthen coalition’s capacity to ‘follow the money’ and understand how the weaknesses of the international tax system affect their country?

- Should PWYP document existing coalition experience of working on taxation issues?