The Importance of Project by Project Disclosure

This blog was originally posted on the PWYP-US site on July 28, 2016.

Indonesia’s vast natural resources wealth includes oil, gas, bauxite, silver, and gold. Indonesia is the world’s second largest tin producer, and one of the top five producers of copper and nickel. The extractives sector plays an outsized role in the Indonesian economy: in 2014, oil, gas, and minerals were responsible for a third of all government revenue, and accounted for more than 50 percent of all non-tax revenue.

Indonesia, an EITI implementing country, has produced three reports since it became an implementing country in 2009. EITI reports were valuable to civil society organizations because of the level of detail found in the data. EITI Indonesia requires oil and gas companies to report the payments they make to the government that emerge from each of their production sharing contracts.

US-listed oil and gas companies operating in Indonesia that report through the EITI include BP, Chevron, CNOOC, ConocoPhillips, ExxonMobil, Petro China, and Total. While EITI Indonesia does not yet explicitly require project-level disclosure, in the mining sector, the reality is that many mining companies operate only a single project in a particular region, making their payment disclosures de facto project-level. Civil society organizations, residents, and local governments have been lobbying for EITI in Indonesia to fully implement the 2013 standard, which requires all companies to report their payments by project.

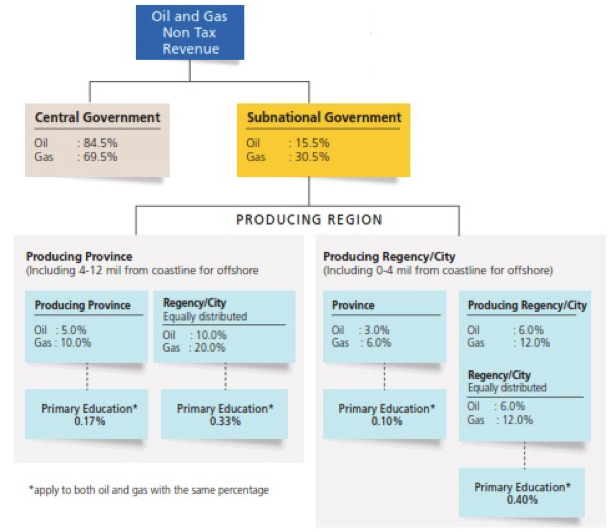

As stated in the law, Indonesia’s resource revenue is primarily collected by the central government, and then a predetermined percentage is redistributed to lower levels of government. It is intended to make sure that citizens living near the extraction projects reap some of benefits. Local governments receive 15 percent of oil revenue generated by local projects, 30 percent of gas revenue, and 80 percent of mineral royalties. Of the 15 percent of oil revenue that is to be redistributed to lower levels of government, 3 percent goes to the producing province, 6 percent goes to the producing district, and 6 percent goes to the districts adjacent to the producing district (as compensation for pollution and other adverse consequences of resource extraction).

Figure 1: Oil and Gas Revenue Sharing Distribution

Source: EITI Indonesia – Contextual Report 2012 – 2013

The American Petroleum Institute proposes that companies report at the first tier below the central government. In the Indonesian context, this would mean that companies would report how much they paid in each province. Reporting at this level would prevent producer district residents from knowing how much revenue was generated from the projects within their district. Without this information, they would be unable to calculate if they received the 6 percent they are owed by the central government.

Ensuring that local governments and communities are properly compensated for the oil, gas, and mining activities, is just one way that project-level data will be used in Indonesia.

Publish What You Pay – Indonesia and its allies have already made use of EITI Indonesia’s limited payment disclosure data:

While we have made great progress using EITI data, our advocacy has been further enhanced when project-level payment data has been available. The implementation of Section 1504 reporting requirements is crucial to ensuring that all project-level data becomes available in Indonesia. This will fill the gaps that currently exist in the EITI data.