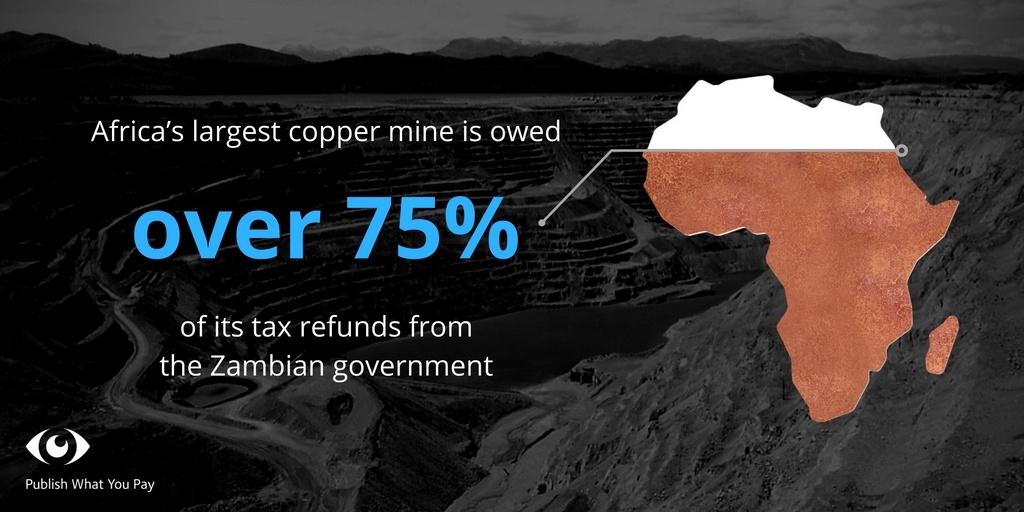

Africa’s largest copper mine is owed over 75% of its tax refunds from the Zambian government, Publish What You Pay (PWYP) Zambia has discovered.

The Kansanshi mine, owned by Kansanshi Mining PLC and ZCCM, is still waiting to receive millions of US dollars in Value Added Tax (VAT) refunds from the Zambian Revenue Agency.

Despite claims that a payment of around ZMK 857,005,562 (USD $85,700,556) was made to the mining company, Kansanshi Mining argued that no VAT refunds were received in 2014.

This information was revealed by analysing seven Extractive Industries Transparency Initiative (EITI) reports published from 2008-2014, which hold information on over forty companies making payment disclosures each year.

Kansanshi Mining company is Zambia’s largest private sector employer with 5,178 workers on its payroll and 3,360 engaged by different contractors. It has been commended for its collaboration with local training and educational institutions, as well as with international organisations such as CARE international and the Young Women’s Christian Association.

The amounts due to Kansanshi Mining went up from USD $91.6 million at the end of 2013 to USD $245.9 million at the end of 2014. VAT refunds were seen as one of the hottest issues in 2014 for a number of reasons.

“Zambians felt that the mines were trying to avoid taxes. This was further sensationalised by the media, particularly social media and political opposition parties”

“For many Zambian citizens, mines claiming VAT refunds were seen as immoral and illegal as they were not aware of the premise upon which the mines claimed VAT credit,” says Lwizya Chanda, Researcher at Caritas Zambia.

“Of course, other sectors which export goods and services are entitled to claim VAT refunds, but given the perceived mistrust between the public and mines on tax issues, Zambians felt that the mines were trying to avoid taxes. This was further sensationalised by the media, particularly social media and political opposition parties. The government owed the mines backlog-claims in excess of USD $500 million.”

Kansanshi Mining has been quoted to say that it will not be investing USD $1.5 billion into the expansion of its Solwezi facility until the Zambian government provides its tax refunds.

Recently, Kansanshi has been aligning all of its investment efforts into helping the Zambian government achieve the United Nations’ Sustainable Development Goals (SDGs). However, without the significant amount of money from VAT refunds, the company claims that it isn’t able to invest in socially responsible initiatives in Zambia.

“Corporate Social Responsibility (CSR) cannot be sustainable if it isn’t based on the needs of people and if we are leaving anyone behind. Kansanshi must contribute to goals to end poverty in all its forms everywhere and ensure inclusive and quality education,” says Lwizya Chanda.

“CSR shouldn’t be limited to certain groups – everyone should be included and their needs assessed, then Kansanshi can have sustainable projects which will lead to fulfilling the SDGs. Community-driven CSR is what PWYP Zambia and Caritas Zambia envisage so we are developing an index tool to let communities gauge CSR conducted by mines. It will be piloted in Solwezi where Kansanshi is located”

PWYP Zambia’s ‘Truth Extraction’ from the EITI reports have divulged countless revelations about Zambia’s EITI process and a lot of points for improvement. Zambia has been producing EITI reports since 2008 in a consistent and commendable effort to combat corruption.

Call for action:

The Publish What You Pay Zambia coalition asks the Zambian government to stop underestimating the importance of mineral revenue collection and utilisation in the extractive sector. PWYP Zambia are concerned about the country’s failure to collect mineral royalty taxes amounting to ZMW 200,205,125 as revealed by the Auditor General’s report in 2015. PWYP Zambia requests that any missing revenues are looked into and all loopholes for financial leakages are addressed.