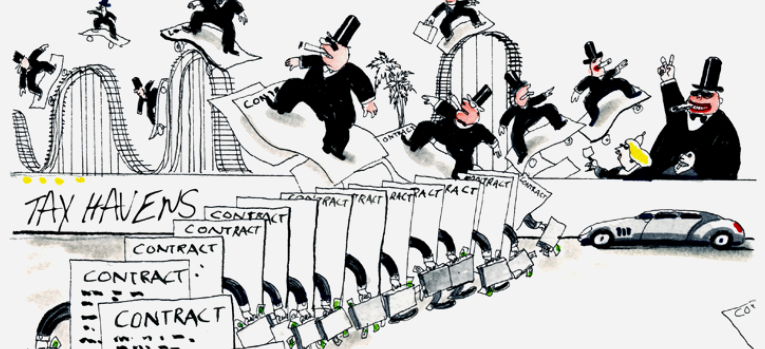

• Tax administrations do not have access to the entire document

trail within multinational companies today

• The Transparency Agreement can change this, on a sampling basis,

so that tax administrations obtain the insight they need

• The Transparency Agreement can be used by individual countries,

or by groups of countries unilaterally

Written by: Frian Aarsnes. Medforfattere: Olav Lundstøl og Morten Eriksen.

ISBN 978-82-93212-44-7

Publication date: December 2014