- African countries have clear opportunities to compete in different stages of the wind and solar power value chains. In solar power, this is through manufacturing components and energy generation. For wind power, they could supply inputs, manufacture components and assemble and install turbines.

- However, Africa lacks some of the key transition minerals needed to produce this type of power, such as those needed to make solar PV equipment.

- In addition, there are some stages in wind and solar energy value chains in which Africa does not appear to be competitive.

- We therefore recommend that Africa focus on those stages of the value chain that it can carry out competitively, rather than trying to create the entire value chain within the continent.

From minerals to energy?

How much of the value chain for renewables Africa can keep within the continent?

Read our latest case study to find out more.

Case study

September 2024

Key messages

Introduction and background

As shown in Part 3 of the “How can Africa make the most of its transition minerals?” report, African countries currently only have a marginal role in manufacturing renewable energy technologies (though new plants for manufacturing battery components have recently opened in Morocco and South Africa).[1],[2]

But do African countries have the capacity to produce renewable energy technologies for their own use on the continent, potentially based on their own energy transition minerals?

In this case study, we consider different renewable energy value chains, and identify which stages African countries could competitively manufacture. We examine African countries’ opportunities to enter each of the different stages of the value chain in turn – raw material (mineral) supply , refining, manufacturing renewable energy technologies and producing renewable energy. We focus on solar and wind energy.

We focus on whether African countries can competitively carry out each of these stages in the value chain. We do not analyse in detail opportunities for Africa to capture more of renewable energy value chains through providing permanent subsidies to firms involved, or applying permanent protection against competition from more competitive imports. This is because even though insisting on value addition within the continent when it is not competitive (or at least not initially) could create jobs and improve productivity over time, this would add to the cost of producing this energy (at least in the short term) if other producers can supply different parts of the value chain more competitively. We therefore advise African countries to specialise in the parts of mineral (and other) value chains in which they are most competitive, rather than seeing it as a necessity to retain the entire value chain on the continent. Focusing on those activities in which they are most competitive could achieve similar economic benefits, but at a lower financial cost (whether in terms of subsidies or higher prices faced by consumers), allowing the savings to go towards other priorities.

We focus on whether African countries can competitively carry out each of these stages in the value chain. We do not analyse in detail opportunities for Africa to capture more of renewable energy value chains through providing permanent subsidies to firms involved, or applying permanent protection against competition from more competitive imports. This is because even though insisting on value addition within the continent when it is not competitive (or at least not initially) could create jobs and improve productivity over time, this would add to the cost of producing this energy (at least in the short term) if other producers can supply different parts of the value chain more competitively. We therefore advise African countries to specialise in the parts of mineral (and other) value chains in which they are most competitive, rather than seeing it as a necessity to retain the entire value chain on the continent. Focusing on those activities in which they are most competitive could achieve similar economic benefits, but at a lower financial cost (whether in terms of subsidies or higher prices faced by consumers), allowing the savings to go towards other priorities.

Solar power (PV and concentrated solar power)

There are two types of solar power – photovoltaic (converting the sun’s light into energy) and thermal (which uses heat from the sun). In the following paragraphs we focus on solar photovoltaic equipment manufacture, turning to concentrated solar power (which is based on thermal solar power) later in the section.

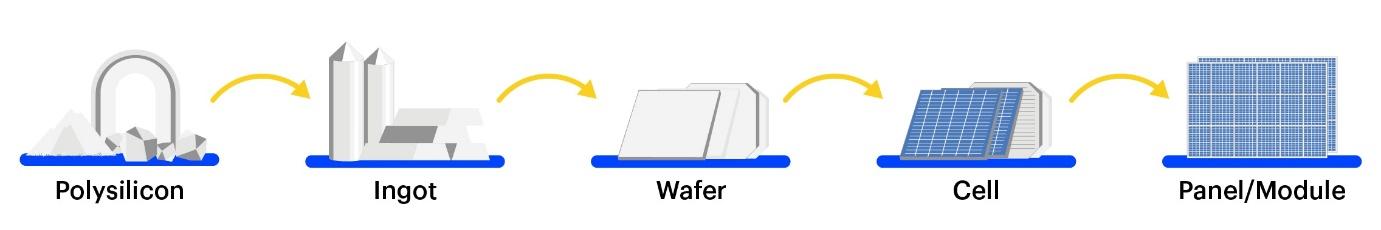

Figure 1: Simplified Solar PV manufacturing value chain[3]

The first step in the value chain for the production of solar photovoltaic (PV) modules is typically to produce polysilicon, which is a high-purity form of silicon metal. [4] But as of 2021, African countries were not significant producers of polysilicon metal.[5] Moreover, according to the British Geological Survey, as of 2021 African countries did not produce silicon metal, which is refined to produce polysilicon.[6],[7] Solar PV equipment can also be made using different combinations of metals, such as cadmium telluride or copper, indium, gallium diselinide; but as of 2021, Africa did not produce the metals involved in those chemistries either (aside from copper). According to the International Trade Centre’s Export Potential Map, no African country has a clear opportunity to move into producing silicon metal.[8] As of 2020, China accounted for 77 percent of global production of polysilicon.[9] China also has almost no competition in the next stage in the value chain (wafers).[10],[11] Many African countries may find manufacture of polysilicon, ingots and wafers particularly challenging because of high levels of investment required to enter this segment, high risks involved and high levels of energy needed for these activities (especially since many African countries struggle with unreliable electricity supply).[12]

What about further down the value chain?

According to UN agency Sustainable Energy for All (SE4All), at least 5 African countries (out of a shortlist of 14) appear to have the conditions in place to manufacture solar photovoltaic technologies. These include (in order of suitability) Egypt, Tunisia, Morocco, South Africa and Algeria. Although Nigeria, Namibia, Kenya, Ghana, Côte d’Ivoire and Rwanda may not have all of the conditions in place, they could overcome these with some policy changes.The conditions include availability of raw materials, labour supply, infrastructure readiness, capital intensity per industrial unit, enabling policies and regulations, current or future demand for output, and production competitiveness.[13]

Yet in some stages of the value chain, African countries may struggle to be competitive. For example, none of these countries currently has assembly costs for solar PV modules as low as those in China.[14] If African countries produced polysilicon, they might still be able to produce solar PV equipment competitively for the domestic market by saving on trade costs; but given that they do not do so, it seems unlikely that they would be able to assemble solar PV modules competitively currently, at least until they can reduce their production costs. Aside from polysilicon, the production of other inputs for the assembly of solar PV modules is also dominated by China.[15] Even if China became less competitive due to rising labour costs, African countries may face competition from other producers which have costs close to that of China’s (e.g., South-East Asia, which currently manufactures at least 5 percent of the world’s solar PV equipment).[16],[17] For these reasons, production of solar PV equipment is “extremely limited” in Africa (though some does occur in Egypt, Morocco and South Africa).[18]

This may suggest that rather than attempt to produce from scratch African producers could be well advised to focus on earlier rungs of the value chain than module assembly – in particular, cell manufacturing (which the UN’s Sustainable Energy for All Agency and other researchers identify as a possible opportunity for African countries). This would mean importing solar PV wafers (likely from China, as noted previously) and transforming them into cells.[19],[20] However, in assessing whether they can be competitive in solar cell manufacture, African countries should take into account the costs of international trade. Since Africa produces neither the polysilicon (nor wafers needed from it) needed to make cells, African countries would need to import these inputs. Perhaps as a result of these challenges, as of 2022, apparently there was only one solar cell manufacturing company in Africa (which was based in Egypt).[21] And since most African countries would apparently not (in the short term) be able to enter the assembly of solar PV modules competitively, African countries might need to export cells to other producers for module assembly.

Key factors for cost competitiveness in the solar PV value chain include the cost of energy and of input materials including aluminium.[22] To boost competitiveness in this value chain, African countries could therefore try to improve the availability of reliable, low-cost electricity, and facilitate intra-African trade in aluminium, which is produced in several African countries.

Another area in which African countries could specialise in solar energy value chains is the production of other equipment that goes into solar power plants (not necessarily solar PV modules). One example is concentrated solar power. Several of the components of concentrated solar power (tower, parabolic trough and linear-Fresnel) do not require specialised expertise to manufacture; and African countries that use concentrated solar power and have competitive manufacturing sectors (such as Morocco and South Africa) could be well-placed to produce these components. For the other components (e.g., mirrors or heat exchangers), over time, efforts to transfer technologies (e.g., through joint ventures) and train workers with the skills needed for the manufacture of these components could lead to production of these components.[23] This is especially true since if the components are used to create plants in their own territories, producers within their own territories will have the advantage of lower shipping costs.

In addition, concentrated solar power is likely to create demand for Africa’s minerals. Chromium, copper, manganese and nickel are used to create equipment for concentrated solar power. As of 2023, South Africa processed chromium domestically, as did Zimbabwe.[24] DRC, Egypt, Namibia, South Africa and Zambia all produced refined copper, while Tanzania produced smelted (but not refined) copper as of 2021.[25] According to ITC’s export potential map, Congo, DRC, Namibia and Zambia have the potential to expand their exports of refined copper.[26] Madagascar, Morocco and South Africa also smelted or refined nickel as of 2021. [27] While some African countries (e.g., Gabon, South Africa) process manganese, it is not clear whether they process it using the same methods that are needed for use in concentrated solar power.

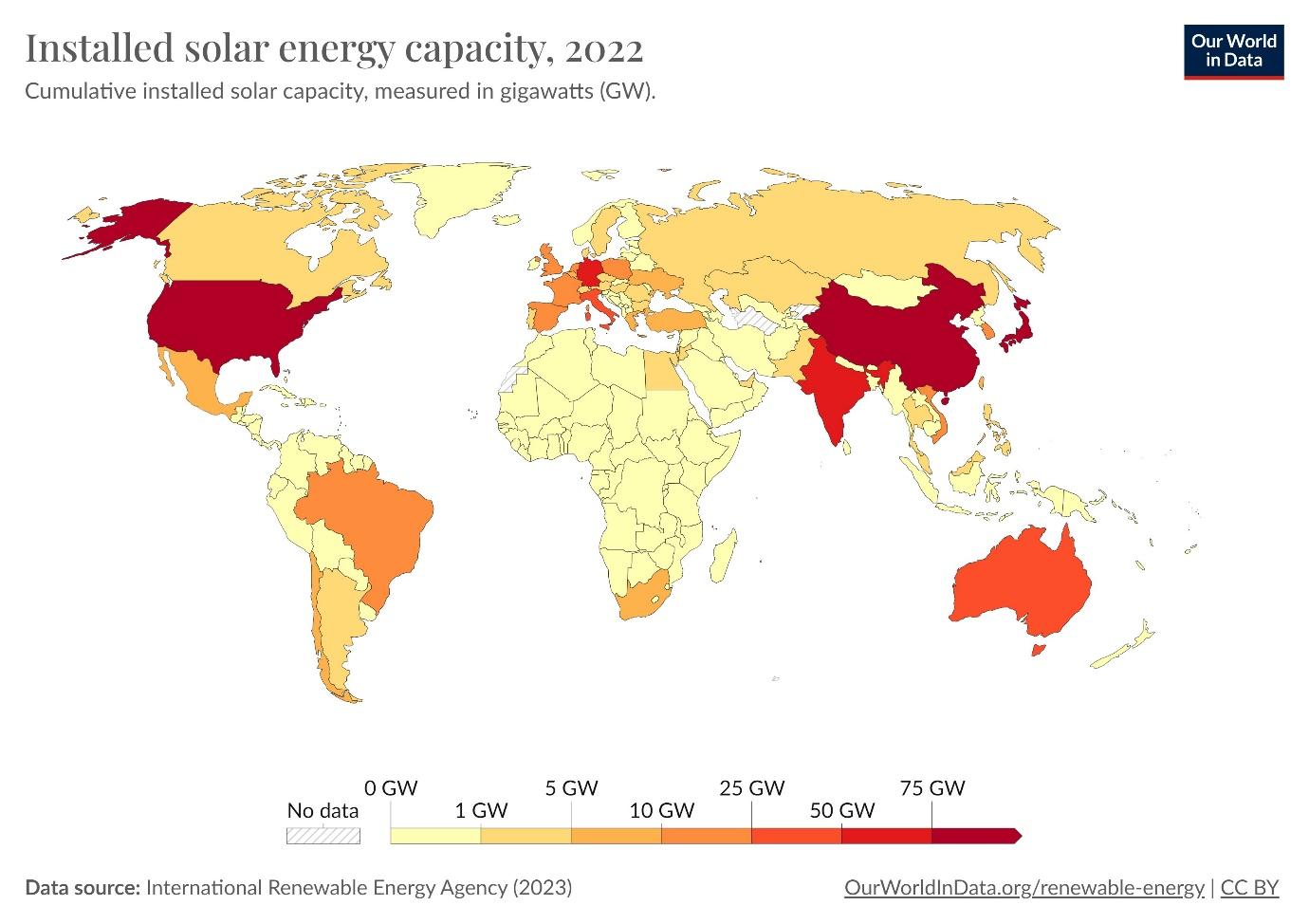

As analysed above, African countries may have opportunities to manufacture some components of solar energy technologies. But what about using increased solar energy within their territories? In theory, given Africa’s exposure to sunshine, the continent should have strong opportunities for solar energy development.[28] But in practice, just a few countries account for most of the installed solar energy capacity in Africa, as shown in figure 2 below.[29]

Figure 2: Installed solar energy capacity by country[30]

However, some African countries have been able to finance and build solar energy plants (in spite of high costs of capital which makes it more difficult to attract investment).[31] As of 2023, countries including Botswana, Kenya, Madagascar Morocco, Namibia and Nigeria are all developing solar energy power plants and/or solar-powered mini-grids.[32] And Côte d’Ivoire, DRC, Mauritius, Senegal, Somalia, South Africa and Zambia all closed new solar energy projects in 2023 that involved private sector participation (though all of these projects, except those in Côte d’Ivoire, Mauritius and South Africa, received financial or technical support from donors).[33] Not all of these countries are among the most attractive investment destinations within Africa. This suggests that many African countries should be able to attract investment in solar energy projects, in spite of 2023’s high interest rates, as long as they can provide (or receive) financial support to the project. To reduce their dependence on donor funding, some African countries may need to improve the attractiveness of investing in solar power within their territories, e.g., through regulatory and tax reforms. Liberalising intra-African trade in electricity, e.g., through the African Continental Free Trade Area, could make it more attractive for investors to fund solar energy projects as they could benefit from economies of scale and reduce risks related to uncertainty over electricity demand (since the investment may not be dependent on demand from only one single economy).

In conclusion, some African countries have opportunities to become more involved in the value chain for solar energy production. In the immediate term, the key opportunities appear to be in a) manufacturing solar PV cells and some equipment for concentrated solar power, and b) generating solar energy. However, for the moment, it may be challenging for Africa to carry out other parts of the solar energy chain.

Wind energy

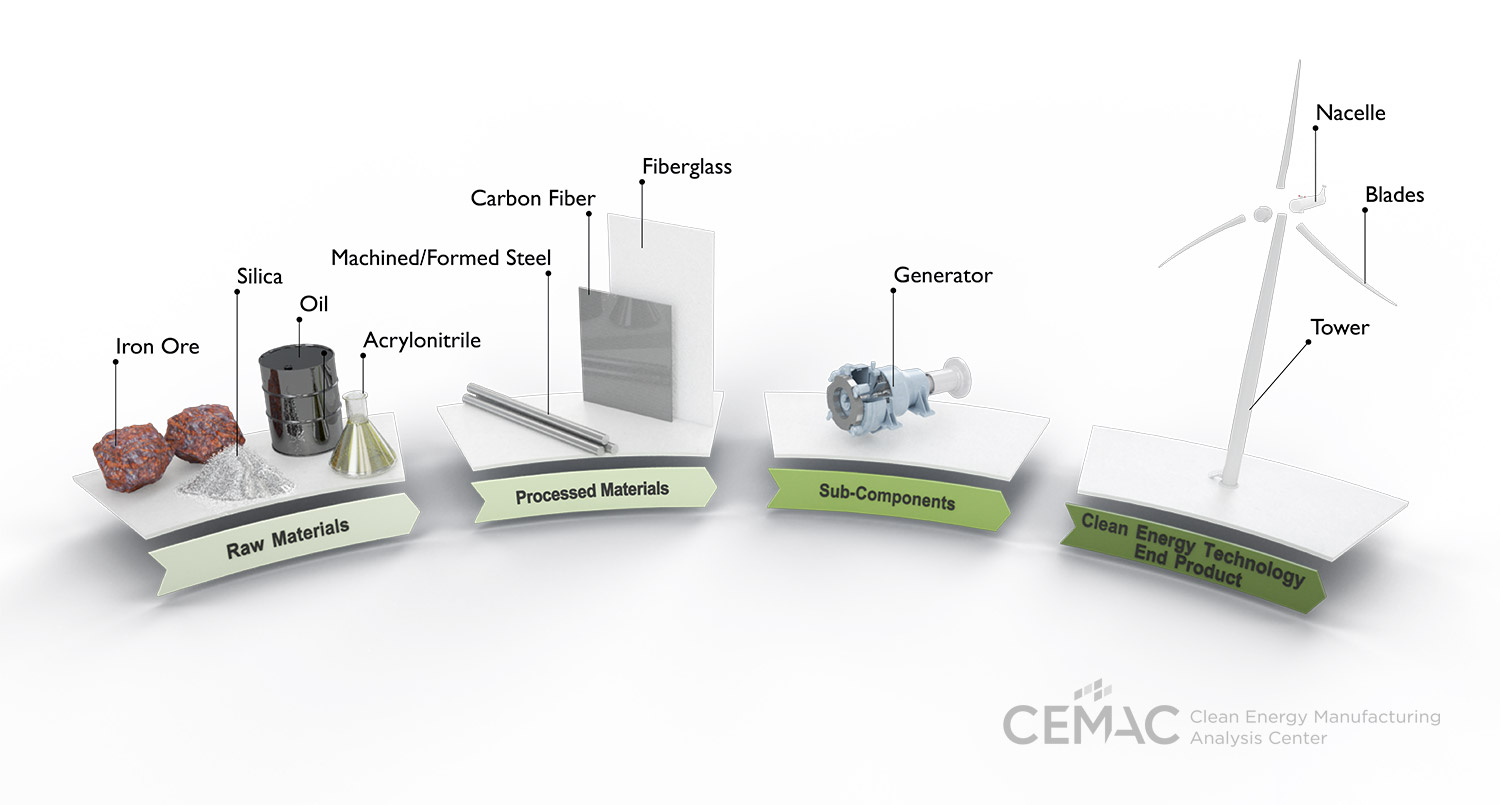

Wind energy is produced by two types of equipment – onshore wind turbines and offshore wind turbines. The value chain involves mineral extraction, mineral processing, component manufacturing (using both processed minerals and a range of other inputs such as concrete, polymers and fibreglass), turbine manufacturing, providing services to support operation and operating wind turbines themselves.[34],[35] How far does Africa have the opportunity to participate more in this value chain?

Figure 3: Wind turbine manufacturing value chain[36]

Let us start with mineral manufacture and processing. Wind turbines require minerals and mineral products that include steel, iron, aluminium, copper, zinc and rare earth elements (generally dysprosium, terbium, neodymium and praseodymium), as well as cement.[37],[38] Africa produces all of these minerals, including in refined form. Does it have the opportunity to process a greater share of them?

For iron and steel, as of 2021, fourteen African countries (Algeria, Angola, DRC, Egypt, Ghana, Kenya, Libya, Mauritania, Morocco, Nigeria, South Africa, Tunisia, Uganda and Zimbabwe) produced steel.[39] However, the ITC’s export potential map is pessimistic about the continent’s potential to produce more, concluding that among currently-producing countries, only South Africa has the potential to export more iron and (non-alloy) steel, and that increased exports will be less than $1m.[40] Iron and steel production in wind value chains may therefore not represent a key opportunity for African countries.

A range of African countries produced the other metals used in making turbines in 2021 through processing raw minerals. For instance, DRC, Egypt, Namibia, South Africa and Zambia all produced refined copper, while Tanzania produced smelted (but not refined) copper. Cameroon, Egypt, Ghana and Mozambique all produced primary aluminium. But in some cases they may be making a loss. For example, Ghana’s aluminium smelter was loss-making up to at least 2018.[41] Perhaps in line with this, ITC’s Export Potential Map considers that only Mozambique and South Africa have potential to expand their exports of unwrought aluminium, by $500 million and $464 million respectively.[42]No African countries produced zinc metal during that year.[43] A wide range of African countries produced cement as of 2018, though the cost is generally high (and may not be competitive, except for supplying to the African market due to advantages of transport costs, though this could change as the price of cement has been falling).[44],[45],[46] For the rare earth elements, we lack complete information but African countries produce some of each of these minerals.[47] For example, Namibia produces terbium and dysprosium. Production of neodymium and praseodymium is expected to start in Malawi and South Africa (in existing mines that are yet to begin production).[48] Burundi and Madagascar also produced rare earth oxides as of 2021,[49] while Uganda, Mozambique, Angola, Tanzania and Kenya all possess reserves and/or resources of these four rare earth elements.[50]

What about further down the value chain?

Some wind turbines are manufactured in Africa – namely in South Africa,[51] while wind turbine towers, blades and electric cables that could be used in the “balance of plant” (a wind turbine component) are manufactured in Egypt.[52] But can African countries increase manufacturing of this equipment? The Global Wind Energy Council (GWEC) thinks so, for some parts of the value chain. These are manufacture of turbine blades, as well as assembling towers supporting wind turbines and the construction work needed to install turbines to operate in a particular location. The other two components of wind turbines (nacelles and balances of plants), which typically require advanced manufacturing sectors that already produce a range of related products, which may be more difficult to achieve in Africa.[53], [54]

The GWEC considers that exporting this equipment outside the continent could be challenging, due to transport costs, so African producers would be more likely to succeed if they focused on serving the African market. In particular, the GWEC thinks that Africa’s opportunities would primarily be to produce this technology for the African market, rather than for export. They suggest that producers in Eastern and Southern Africa would be able to serve demand for that part of the continent. The countries that GWEC argue could be supplied by a wind energy market in Eastern and Southern Africa are Angola, Botswana Burundi, Djibouti, DRC, Egypt, Eritrea, Eswatini, Ethiopia, Kenya, Lesotho, Malawi, Mozambique, Namibia, Rwanda, South Africa, South Sudan, Sudan, Tanzania, Uganda, Zambia and Zimbabwe. Somalia is excluded (presumably due to limited road and rail links). They suggest that Egypt and South Africa would have sufficiently developed manufacturing sectors to produce wind turbine blades.[55] Although one might think that Morocco could have a similarly advanced manufacturing sector, a turbine blade factory established there was closed down for commercial reasons in 2022.[56]

The wind equipment sector is becoming increasingly competitive. Western wind equipment manufacturers have been laying off employees and focusing on the most profitable projects as they struggle to make a profit. Meanwhile, Chinese manufacturers, which have several competitive advantages, are cutting prices and trying to expand their sales into overseas markets. This affects both onshore and offshore wind turbines. Demand for wind turbines is expected to grow in the longer term but it is not clear whether the competitive pressure (and difficulty of making a profit in the market for all but the most efficient manufacturers) will lessen.[57] This suggests that the benefits to Africa of manufacturing turbine components could be limited, at least in the short term.

What about Africa’s opportunities to use wind energy to add to domestic energy production?

In terms of the technical potential, this is high and could represent a substantial expansion from current levels. There are various estimates, ranging from One estimate indicates that it could expand from 6.5 GW of capacity installed in 2020 to 100 GW, while another finds that it could expand to 461 GW.[58] A further estimate states that technical capacity could be as high as 33,642 GW, meeting Africa’s total electricity demand 250 times over. The researchers also found that the Eastern and Southern African regions (excluding Somalia) would have technical wind power potential of around 1.800 GW, which supports GWEC’s idea of the feasibility of a sub-regional market for wind turbines in Eastern and Southern Africa.[59],[60] This is because if any of these estimates are correct, then there would be more than capacity to support several African blade manufacturing plants, even if Africa taps into only a small fraction of its wind energy capacity. Moreover, according to GWEC, African countries are already planning to add 86 GW in wind energy capacity, including over 7GW in Egypt alone.[61] It therefore appears that, based on existing capacity addition plans, there is ample demand to sustain a regional market in wind energy equipment in Eastern and Southern Africa.

New wind power projects have been announced in Algeria, Angola, Chad, Egypt, Ethiopia, Ghana, Kenya, Madagascar, Malawi, Mali, Morocco, Namibia, Niger, South Africa, Sudan, Uganda, Zambia, and potentially other countries.[62] As well as having the potential to meet a large share of Africa’s electricity needs, wind energy may therefore also create opportunities for African firms wanting to participate in wind turbine value chains. As noted above, a range of African countries have recently been able to attract investment in wind energy, which underscores the continent’s potential for the future. Nevertheless, the continent faces challenges to realising its full potential, linked e.g., to having the right policies in place to make it attractive to invest (e.g., on government procurement) and upgrading electricity networks.[63]

Endnotes

[1] Harry Dempsey, ‘Chinese Battery Groups Invest in Morocco to Serve Western Markets’, Financial Times, 27 September 2023, sec. Batteries, https://www.ft.com/content/9539f746-82bf-49db-ae87-237196a60c88.

[2] Irma Venter, ‘Polarium Opens Lithium-Ion Battery Assembly Plant in Cape Town’, Engineering News, 29 April 2022, https://www.engineeringnews.co.za/article/polarium-opens-lithium-ion-battery-assembly-plant-in-cape-town-2022-04-29.

[3] IEA, ‘Solar PV Global Supply Chains’ (Paris: IEA, 2022), https://www.iea.org/reports/solar-pv-global-supply-chains.

[4] Edward Lees and Ulrik Fugmann, ‘What You Need to Know about Polysilicon and Its Role in Solar Modules’, accessed 26 February 2024, https://viewpoint.bnpparibas-am.com/what-you-need-to-know-about-polysilicon-and-its-role-in-solar-modules/.

[5] The main producers were in Asia, North America and Europe. Together, the rest of the world accounted for only 1 percent of polysilicon production. IEA, ‘Solar PV Global Supply Chains’.

[6] N E Idoine et al., WORLD MINERAL PRODUCTION 2017–21 (Keyworth, Nottingham: British Geological Survey, 2023), https://nora.nerc.ac.uk/id/eprint/534316/1/WMP_2017_2021_FINAL.pdf.

[7] According to the US Geological Survey, nor was any African country a major producer of silicon in 2022 (USGS only displays data on major producers). ‘Mineral Commodity Summaries 2024 – SILICON Data Release – ScienceBase-Catalog’, USGS, 30 January 2024, https://www.sciencebase.gov/catalog/item/65b7d888d34e36a39045b51b.

[8] ITC Trade and Market Intelligence Section, ‘Export Potential’, Export Potential Map Spot Export Opportunities for Trade Development, accessed 27 February 2024, https://exportpotential.intracen.org/en/products/gap-chart?fromMarker=re&exporter=1&toMarker=w&market=w&whatMarker=k. See Annex II of the present report for an explanation of how opportunities are assessed.

[9] Lees and Fugmann, ‘What You Need to Know about Polysilicon and Its Role in Solar Modules’.

[10] Sustainable Energy for All, ‘Africa Renewable Energy Manufacturing Opportunity and Advancement’ (Sustainable Energy for All, 2023), 9, https://www.seforall.org/system/files/2023-01/%5BFINAL%5D%2020220115_ZOD_SEForAll_AfricanManufacturingReport.pdf.

[11] Antonio Andreoni and Elvis Avenyo, ‘Critical Minerals and Routes to Diversification in Africa: Opportunities for Diversification into Renewable Energy Technologies – The Case of Morocco’ (United Nations Conference on Trade and Develoment, August 2023), 11–12, https://unctad.org/system/files/non-official-document/edar2023_BP2_en.pdf.

[12] Andreoni and Avenyo, ‘Critical Minerals and Routes to Diversification in Africa: Opportunities’, 12.

[13] Sustainable Energy for All, ‘Africa Renewable Energy Manufacturing’, 9–10.

[14] Sustainable Energy for All, 10.

[15] Andreoni and Avenyo, ‘Critical Minerals and Routes to Diversification in Africa: Opportunities’, 11.

[16] ‘Current and Projected Geographical Concentration for Manufacturing Operations for Key Clean Energy Technologies, 2022-2030’, IEA, 11 May 2023, https://www.iea.org/data-and-statistics/charts/current-and-projected-geographical-concentration-for-manufacturing-operations-for-key-clean-energy-technologies-2022-2030.

[17] IEA, ‘Solar PV Global Supply Chains’.

[18] Andreoni and Avenyo, ‘Critical Minerals and Routes to Diversification in Africa: Opportunities’, 12.

[19] Andreoni and Avenyo, 12.

[20] Sustainable Energy for All, ‘Africa Renewable Energy Manufacturing’, 9.

[21] Benjamin Boakye and Charles Gyamfi Ofori, ‘THE SOLAR PV VALUE CHAIN: AN ASSESSMENT OF OPPORTUNITIES FOR AFRICA IN THE CONTEXT OF ENERGY TRANSITION AND THE AFRICAN CONTINENTAL FREE TRADE AREA’ (Africa Centre for Energy Policy and Ford Foundation, October 2022), https://acep.africa/wp-content/uploads/2023/03/The-Solar-PV-Value-Chain-An-Assessment-of-Opportunities-for-Africa-in-the-Context-of-Energy-Transition-and-AfCFTA.pdf.

[22] Boakye and Ofori, ‘THE SOLAR PV VALUE CHAIN: AN ASSESSMENT OF OPPORTUNITIES FOR AFRICA IN THE CONTEXT OF ENERGY TRANSITION AND THE AFRICAN CONTINENTAL FREE TRADE AREA’.

[23] Andreoni and Avenyo, ‘Critical Minerals and Routes to Diversification in Africa: Opportunities’, 13.

[24] MacDonald Dzirutwe, ‘Zimbabwe Bans Chrome Ore Exports to Boost Ferrochrome Industry’, Reuters, 3 August 2021, sec. Africa, https://www.reuters.com/article/idUSL8N2PA65U/; Alex Donaldson, ‘Jubilee Secures Six-Year Chrome Deal in South Africa’, Mining Technology, 8 June 2023, https://www.mining-technology.com/?p=641679; ‘SAIMM – African Chrome Fields Unveils World-First Mining Technology’, SAIMM The Southern African Institute of Mining and Metallurgy, 11 September 2023, https://www.saimm.co.za/press-releases/1039-african-chrome-fields-unveils-world-first-mining-technology..

[25] ‘World Mineral Statistics Data’.

[26] ITC Trade and Market Intelligence Section, ‘Export Potential’.

[27] ‘World Mineral Statistics Data’.

[28] Andreoni and Avenyo, ‘Critical Minerals and Routes to Diversification in Africa: Opportunities’.

[29] IRENA and AfDB, Renewable Energy Market Analysis: Africa and Its Regions (Abu Dhabi and Abidjan, 2022), https://www.irena.org/-/media/Files/IRENA/Agency/Publication/2022/Jan/IRENA_Market_Africa_2022.pdf?la=en&hash=BC8DEB8130CF9CC1C28FFE87ECBA519B32076013.

[30] International Renewable Energy Agency, Processed by Our World in Data, ‘Installed Solar Energy Capacity’, Our World in Data, 12 December 2023, https://ourworldindata.org/grapher/installed-solar-pv-capacity?tab=map.

[31] Todd Moss, ‘Why Isn’t Solar Scaling in Africa?’, Asterisk, February 2024, https://asteriskmag.com/issues/05/why-isnt-solar-scaling-in-africa.

[32] Ian Lewis, ‘Solar Leads the Way as Africa Attracts Fresh Renewables Investment’, African Business, 21 June 2023, https://african.business/2023/06/energy-resources/solar-leads-the-way-as-africa-attracts-fresh-renewables-investment.

[33] World Bank, ‘World Bank Private Participation in Infrastructure (PPI) Database’, n.d., https://ppi.worldbank.org/en/ppi.

[34] International Energy Agency, ‘The Role of Critical Minerals in Clean Energy Transitions’ (IEA Publications, May 2021), https://iea.blob.core.windows.net/assets/ffd2a83b-8c30-4e9d-980a-52b6d9a86fdc/TheRoleofCriticalMineralsinCleanEnergyTransitions.pdf.

[35] Daniel M. Guttmann and Rustem Zagretdinov, ‘The Wind Energy Sector Market Opportunities across the Value Chain’ (BDO, 2023), 5, https://www.bdo.co.uk/getmedia/563de778-4c87-4ad0-97a9-045cb0cd42f0/NRE-BDO-Report-The-Wind-Energy-Sector.pdf.

[36] Joint Institute for Strategic Energy Analysis, ‘Manufacturing Snapshot: Wind Turbines’, CEMAC Clean Energy Manufacturing Analysis Center, accessed 17 June 2024, https://www.manufacturingcleanenergy.org/benchmark/wind.html.

[37] P. Alves Dias et al., The Role of Rare Earth Elements in Wind Energy and Electric Mobility, EUR 30488 EN, JRC Science for Policy Reports JRC122671 (Luxembourg: Publication Office of the European Union, 2020), doi:10.2760/303258.

[38] International Energy Agency, ‘The Role of Critical Minerals in Clean Energy Transitions’.

[39] ‘Production of Steel, Crude’, BGS Minerals UK, accessed 27 February 2024, https://www2.bgs.ac.uk/mineralsUK/statistics/wms.cfc?method=listResults&dataType=Production&commodity=73&dateFrom=2021&dateTo=2021&country=&agreeToTsAndCs=agreed.

[40] ITC Trade and Market Intelligence Section, ‘Export Potential’.

[41] Benjamin Boakye and Charles Gyamfi Ofori, ‘EVALUATION OF THE PROPOSED INTEGRATED ALUMINIUM INDUSTRY AND THE $2 BILLION CHINESE BARTER DEAL’ (Africa Centre for Energy Policy, September 2019), 7, https://acep.africa/wp-content/uploads/2023/03/Evaluation-Of-The-Proposed-Integrated-Aluminium-Industry-And-the-2-Billion-Chinese-Barter-Deal.pdf.

[42] ITC Trade and Market Intelligence Section, ‘Export Potential’.

[43] ‘World Mineral Statistics Data’.

[44] ‘Cement Production in Africa by Country’, Statista, August 2022, https://www.statista.com/statistics/1049772/cement-production-africa-by-country/.

[45] Tristan Reed, ‘Why Is the Price of Cement so High in Africa?’, Let’s Talk Development (blog), 16 June 2022, https://blogs.worldbank.org/developmenttalk/why-price-cement-so-high-africa.

[46] Fabrizio Leone, Rocco Macchiavello, and Tristan Reed, ‘The Falling Price of Cement in Africa’, World Bank Policy Research Working Papers 9706, June 2022, https://documents1.worldbank.org/curated/en/727041624328488778/pdf/The-Falling-Price-of-Cement-in-Africa.pdf.

[47] Alves Dias et al., The Role of Rare Earth Elements in Wind Energy and Electric Mobility, EUR 30488 EN.

[48] Gracelin Baskaran, ‘Could Africa Replace China as the World’s Source of Rare Earth Elements?’, Brookings, 29 December 2022, https://www.brookings.edu/articles/could-africa-replace-china-as-the-worlds-source-of-rare-earth-elements/.

[49] Idoine et al., WORLD MINERAL PRODUCTION 2017–21.

[50] Alves Dias et al., The Role of Rare Earth Elements in Wind Energy and Electric Mobility, EUR 30488 EN.

[51] Janet Richardson, ‘Wind Turbine Manufacturers’, The Renewable Energy Hub UK, 4 October 2023, https://www.renewableenergyhub.co.uk/main/wind-turbines/manufacturers-of-wind-turbine.

[52] Global Wind Energy Council, ‘The Status of Wind in Africa Report 2023’ (Global Wind Energy Council, October 2023), 29, https://gwec.net/wp-content/uploads/2023/10/Status-of-Wind-in-Africa-Report-V4.pdf.

[53] Global Wind Energy Council, 27.

[54] Wind energy in Africa already creates jobs during the construction phase. It created 12,400 direct jobs in projects that account for one third of the continent’s wind energy capacity. Global Wind Energy Council, 27.

[55] Global Wind Energy Council, 27–28.

[56] Global Wind Energy Council, 29.

[57] Endri Lico, ‘The Wind Energy Industry Paradox: Short-Term Headwinds and Long-Term Optimism’, Wood Mackenzie, 2 March 2023, https://www.woodmac.com/news/opinion/wind-energy-industry-paradox/.

[58] Linda Munyengeterwa and Sean Whittaker, ‘Powering Africa’s Sustainable Development through Wind’, Development and a Changing Climate (blog), 24 June 2021, https://blogs.worldbank.org/climatechange/powering-africas-sustainable-development-through-wind; Solomon Boadu and Ebenezer Otoo, ‘A Comprehensive Review on Wind Energy in Africa: Challenges, Benefits and Recommendations’, Renewable and Sustainable Energy Reviews 191 (March 2024): 114035, https://doi.org/10.1016/j.rser.2023.114035.

[59] IRENA and AfDB, Renewable Energy Market Analysis: Africa and Its Regions, 43.

[60] According to GWEC, a blade manufacturing plant would only need orders from wind turbines with 4 GW of capacity to be commercially viable. Global Wind Energy Council, ‘The Status of Wind in Africa Report 2023’, 17, 28.

[61] Global Wind Energy Council, 6.

[62] Global Wind Energy Council, 18–19.

[63] Solomon Boadu and Ebenezer Otoo, ‘A Comprehensive Review on Wind Energy in Africa: Challenges, Benefits and Recommendations’, Renewable and Sustainable Energy Reviews 191 (1 March 2024): 114035, https://doi.org/10.1016/j.rser.2023.114035.